Advisers See Greater Employer Interest in Financial Wellness

By Melissa A. Winn, ebn, Employee Benefits News October 29, 2014

Benefit brokers say employers are more and more looking toward financial wellness programs to assist employees saddled with increased health care costs.

As employers continue to shift health care costs to their employees, benefit brokers say they’re seeing an uptick in the number of employers looking to implement financial wellness programs as a way to help their workers better manage their short and long-term financial needs and goals.

A recent survey of life and health insurance brokers reveals that employers are concerned their existing benefit packages are not adequately meeting employees’ most critical needs and that employers are exploring additional benefits beyond traditional health coverage, including financial wellness programs.

The findings also show employers are concerned their employees are less satisfied with benefit packages due to limited options for health insurance plans that require higher deductibles and premiums.

David Kilby, president of FinFit, the Virginia Beach-based company that conducted the survey of brokers and agents, says the benefits industry is recognizing “the pressing need for financial wellness programs in the workplace that help people better manage difficult financial circumstances and get back on track quickly.”

Tony Franchimone, a principal with Retirement Benefits Group agrees, saying the increase in health care costs and employee concerns about that have driven employers to take a more parental approach toward employees and how they want to teach or educate them to be financially well.

Nearly half of brokers say their employer clients have expressed interest in a benefit that could offer short-term loans to help employees cover unexpected emergencies and health care expenses, FinFit said.

The survey also found:

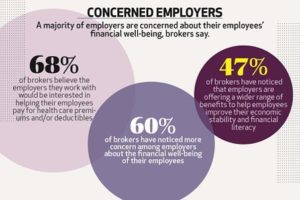

- 60% of brokers have noticed greater concern among employers about the financial well-being of employees.

- 68% of advisers strongly believe the employers they work with would be interested in participating in programs that help employees cover the cost of health care coverage premiums and/or deductibles.

- 47% of respondents have noticed that employers are offering a wider range of benefits aimed at helping employees improve their financial literacy and economic stability.

Education and Tools

While many financial wellness programs utilize tools such as auto-enrollment and auto-escalation features to engage employees in retirement and other financial savings programs, Franchimone says it’s important for advisers to go beyond those tools and focus on education.

Through the use of continued education, employers can help employees better understand how to use their retirement and other financial savings benefits, understand the importance of using them, and better appreciate the benefit offerings their employer is providing, says Franchimone.

“The more comfortable people are with their understanding of their financial benefits, the more comfortable they are going to feel that they are on the right path and the more satisfied they are going to be with their work experience,” Franchimone says.

According to the FinFit survey, 71% of employees reported an increase in financial knowledge and wellbeing as a direct result of participation in a financial wellness program. Two-thirds of employees also said they’ve been able to increase their monthly savings, while 85% of employers reported employees became more productive at work after using a financial wellness program to resolve a personal challenge.

Franchimone says along with group meetings to educate employees, they’ve started to further enhance their employer programs by offering topical webinars for employees. He says a lot of clients are now also offering a sort of “finance 101” class to teach the basics of finance, including what a 401(k) is, learning about mutual funds and estate planning, etc.

Smart, Timely Communication on Retirement May Be Key to Engaging Younger Generation

By Nick Otto, ebn- Employee Benefit News, September 22, 2014

Having an engaging 401(k) plan recordkeeper, partnered with innovative online educational tools, may provide a solution to piercing the Gen Y markets as more and more of the current employee base moves closer to retirement.

As a financially successful group, the baby boomer generation has put more than $6 trillion into a still growing retirement assets, according to recent data from Cerulli Associates. However, the boomers have already begun to distribute their 401(k) retirements, and according Cerulli, estimates show 2016 will be the definitive year that distributions outpace contributions. Further, by 2019, the gap between contributions and distributions will be closing in on $60 billion.

But the lack of engagement isn’t just seen in retirement alone, says Matt Fellowes, founder and CEO of HelloWallet and former scholar at the Brookings Institute, but can also be seen in the health markets as more and more employers start to provide consumer-directed health plans and health savings accounts.

This is the broad problem employers have today, he says. “And it’s particularly challenging with millennials, because retirement is far off,” he says. “Younger people are focused on issues more relevant,” he adds, like paying off credit card and college debt.

Gen Y’s saving habits are going to determine the future asset base of financial service firms, Cerulli says in its recent report. “Plan sponsors and recordkeepers must be aware of these realities and use a wide range of resources to help plan participants save more,” according to the report.

Fellowes advises employers and plan sponsors to provide a value proposition that is broader than just retirement — “Most millenials don’t want to talk about retirement. You’re basically asking to be ignored,” he says. As an example, HelloWallet offers consultations on everyday financial obstacles like money management and reducing debt, which frees up capital that can be directed to retirement savings in the future, he says.

This also allows an in-road to the younger generations for future discussions on retirement, another hurdle the Cerulli spotlighted.

As employers tell younger employees to start saving when they’re already living paycheck to paycheck, it reinforces the notion that employers don’t understand their employees, Fellowes adds.

Some suggestions Cerulli provides include a reduced, but intelligent amount of communications between employers and staff: for instance, initiating 401(k) outreach programs closer to bonuses and pay increases. Also, the report notes more personalized and actionable communications will lead to more success.

“Ultimately, there is no individual cure-all for low deferral rates and participation inaction,” the report’s authors say. But with a Gen Y population just 2 million shy of the baby boomers — filling in the deferral gap can be accomplished, “It’s just a matter of getting the demographic more in tune with the importance of saving.”

10 Year-End Tax Tips

Financial Planning.com, Accounting Today November 2, 2014

More than 50 popular tax provisions expired at the end of 2013. Without legislative action, businesses won’t get a credit for research activities or be able to immediately deduct one-half of the cost of new business equipment. Individuals would lose benefits like the ability to deduct tuition and state and local sales taxes. Grant Thornton’s Year-end Tax Guide for 2014 discusses these and other issues that taxpayers and taxpaying entities should be thinking about now.

1. Accelerate Deductions and Defer Income

Deferring tax is a cornerstone of tax planning. Generally, this means accelerating deductions into the current year and deferring income into next year. There are plenty of income items and expenses you may be able to control. Consider deferring bonuses, consulting income or self-employment income. On the deduction side, you may be able to accelerate state and local income taxes, interest payments and real estate taxes.

- Bunch Itemized Deductions

Many expenses can be deducted only if they exceed a certain percentage of your adjusted gross income. Bunching itemized deductible expenses into one year can help you exceed these AGI floors. Consider scheduling your costly non-urgent medical procedures in a single year to exceed the 10% AGI floor for medical expenses (7.5% for taxpayers age 65 and older). This may mean moving up a procedure into this year or postponing it until next year, when you’ll have more medical expenses. To exceed the 2% AGI floor for miscellaneous expenses, bunch professional fees like legal advice and tax planning, as well as unreimbursed business expenses such as travel and vehicle costs.

- Make Up a Tax Shortfall with Increased Withholding

Don’t forget that taxes are due throughout the year. Check your withholding and estimated tax payments now while you have time to fix a problem. If you’re in danger of an underpayment penalty, try to make up the shortfall through increased withholding on your salary or bonuses. A bigger estimated tax payment can still leave you exposed to penalties for previous quarters, while withholding is considered to have been paid ratably throughout the year.

- Leverage Retirement Account Tax Savings

It’s not too late to increase contributions to a retirement account. Traditional retirement accounts like a 401(k) or individual retirement account still offer some of the best tax savings. Contributions reduce taxable income at the time that you make them, and you don’t pay taxes until you take the money out at retirement. The 2014 contribution limits are $17,500 for a 401(k) and $5,500 for an IRA (not including catch-up contributions for those 50 years of age and older).

5. Leverage State and Local Sales Tax Deduction

If you itemize deductions, you can elect to deduct state and local sales tax instead of state income taxes. (While this is one of the tax extender provisions that has currently expired, Congress is likely to extend this popular tax break after the midterm elections.) This is valuable if you live in a state without an income tax but can also provide a bigger deduction in other states if you made big purchases subject to sales tax (like a car, boat, home or all three). The Internal Revenue Service has a table allowing you to claim a standard sales tax deduction so you don’t have to save all your receipts during the year. This table is based on your income, family size and the local sales tax rate, and you can add the tax from large purchases on top of the standard amount. If you’ve already paid enough sales tax that you’ll make this election for 2014, consider making any planned large purchases before the end of the year. If you wait to make the purchase in 2015 and won’t be electing to deduct sales tax that year, you won’t get any tax benefit.

- Reconsider a Roth IRA Rollover

It has become very popular in recent years to convert a traditional IRA into a Roth IRA. This type of rollover allows you to pay tax on the conversion in exchange for no taxes in the future (if withdrawals are made properly). If you converted your account this year, reexamine the rollover. If the value went down, you have until your extended filing deadline to reverse the conversion. That way, you may be able to perform a conversion later and pay less tax.

- Don’t Squander Your Gift Tax Exclusion

You can give up to $14,000 to as many people as you wish in 2014, free of gift or estate tax. You get a new annual gift tax exclusion every year, so don’t let it go to waste. If you combine gifts with a spouse, you can give up to $28,000 per beneficiary, per year. For example, a couple with three grown children who are married could give each couple $56,000 each and remove a total of $168,000 gift tax free in a single year. Even more could be given tax free if grandchildren are included.

- Understand the New Home Office Deduction Safe Harbor

You can deduct some of the cost of your home if you use your home as your principal place of business, use it to meet clients and customers in the normal course of business, or your office is a separate structure not attached to your home. The amount of this deduction has long been a source of controversy, but the IRS has a new safe harbor this year that allows you to deduct up to $5 per square foot of home office space up to $1,500 per year.

- Maximize “Above-the-Line” Deductions

Above-the-line deductions are valuable because you deduct them before you calculate your AGI. They are allowed in full and make it less likely that your other tax benefits will be limited. Common above-the-line deductions include traditional IRA and health savings account (HSA) contributions, moving expenses, self-employed health insurance costs and alimony payments.

- Perform an Overall Financial Checkup

The end of the year is always a good time to assess your current financial situation and plan for the future. You should think about cash flow, health care, retirement, investment and estate planning. Check wills, powers of attorney and health care proxies for changes that may have occurred during the year. Use the open enrollment period to reconsider employer-sponsored programs that could reduce next year’s taxable income. HSAs and flexible spending accounts for dependent care or medical expenses allow you to use pre-tax dollars. Remember, it’s never too early or too late to start planning for the future!